hotel-rosa-ski-inn.ru Gainers & Losers

Gainers & Losers

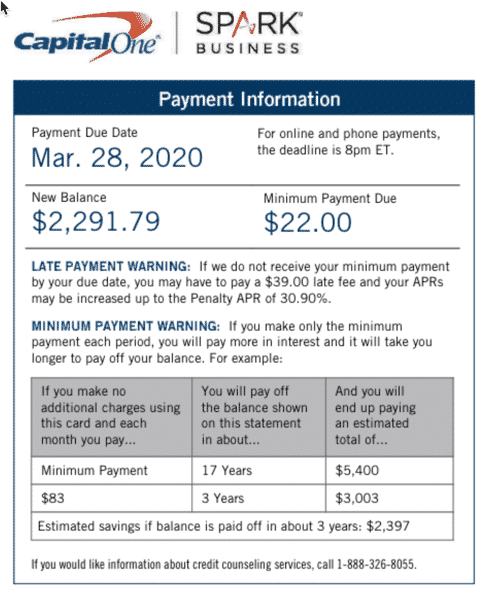

How To Calculate Minimum Payment On Credit Card

The most widely used method credit card issuers use to calculate the monthly interest payment is the average daily balance, or the ADB method. Since months vary. Somewhere in your credit card disclosure statement the card company will tell you something like "your minimum payment will be 2% of the balance or $ For credit cards, this is calculated as your minimum payment. Your monthly payment is calculated as the percent of your current outstanding balance you entered. How credit card issuers calculate minimum payments · A set dollar amount, typically $35 · A percentage of your balance, plus interest charges and late fees. How credit card issuers calculate minimum payments · A set dollar amount, typically $35 · A percentage of your balance, plus interest charges and late fees. All payments will make a dent in the amount you owe. If your minimum payment is $50 and you pay $50, your balance goes down by $ The more you. Credit card minimum payments are usually calculated based on the monthly statement balance. The minimum payment could be a percentage of the balance, plus new. Credit card rate Minimum payment:*This entry is hotel-rosa-ski-inn.ru an amount between 0% and 20%? A minimum payment is typically around 1% to 5% of your balance, depending on the issuer. Typically, you have to pay that percentage or a dollar amount of around. The most widely used method credit card issuers use to calculate the monthly interest payment is the average daily balance, or the ADB method. Since months vary. Somewhere in your credit card disclosure statement the card company will tell you something like "your minimum payment will be 2% of the balance or $ For credit cards, this is calculated as your minimum payment. Your monthly payment is calculated as the percent of your current outstanding balance you entered. How credit card issuers calculate minimum payments · A set dollar amount, typically $35 · A percentage of your balance, plus interest charges and late fees. How credit card issuers calculate minimum payments · A set dollar amount, typically $35 · A percentage of your balance, plus interest charges and late fees. All payments will make a dent in the amount you owe. If your minimum payment is $50 and you pay $50, your balance goes down by $ The more you. Credit card minimum payments are usually calculated based on the monthly statement balance. The minimum payment could be a percentage of the balance, plus new. Credit card rate Minimum payment:*This entry is hotel-rosa-ski-inn.ru an amount between 0% and 20%? A minimum payment is typically around 1% to 5% of your balance, depending on the issuer. Typically, you have to pay that percentage or a dollar amount of around.

The minimum amount you must pay each month on your credit card. The minimum payment is the greater of the following two amounts: A fixed amount (for example. To determine what portion of this is applied to interest, multiple your outstanding balance by your interest rate ($1, x 15% = $). This is the amount of. Many credit card issuers allow cardholders to carry a balance month-to-month and make “minimum payments” (usually around $25 or 3% of the total balance) partly. Helps you work out: how long it will take to pay off your card by making minimum repayments; how much time and money you'll save by making higher repayments. Use this calculator to see what it will take to pay off your credit card balance, and what you can change to meet your repayment goals. Flat minimum payment multipliers are typically between % and 5%. If, for example, your statement balance is $5, and your minimum payment percentage is 2%. The minimum payment is 2% of the outstanding monthly balance, or $20, whichever is greater. This percentage is calculated by utilizing "average daily. If you have difficulty finding it in those two places, you can call your bank and ask. How is credit card minimum payment calculated. Credit card minimum. Your monthly payment is calculated as the percent of your current outstanding balance you entered, but will never be less than Your monthly payment will. Minimum payment ; Interest rate ; Credit card 3: ; Name. There is usually a dollar amount for your minimum monthly payment, and it may be written like, "$35 or 2% of your balance plus fees, whichever is greater." Each. Minimum payments are calculated differently bank by bank. Typically, your minimum payment is the greater of a certain percentage of your balance (1% or 2%) or a. Typically, it is something like some percentage of your statement balance (usually %) or a flat dollar amount ($35 is common) whichever is. MINIMUM PAYMENT. This is the percent of your outstanding balance that will be used to calculate your minimum payment for the month. Your monthly payment is. The amount of the minimum monthly payment is calculated as a small percentage of the consumer's total credit balance. Key Takeaways. The minimum monthly payment. Credit card rate Minimum payment:*This entry is hotel-rosa-ski-inn.ru an amount between 0% and 20%? When calculating the minimum payment total cost estimate, a card issuer must total the dollar amount of the interest and principal that the consumer would pay. See how much extra you will pay if you only make minimum payments on your credit card bill · The total amount of you'll pay in principle and interest charges. Use our free minimum payment calculator to see how long it will take to pay off your credit card balances and how much you'll pay in total interest charges. For example, let's say your credit card charges a 2% flat percentage, or $10, whichever is higher for the minimum payment. If your statement balance is $

Free Bingo Real Cash

Welcome to the home of fair bingo, where you can enjoy free bingo games in the Zero Room, with cash prizes to be won. Terms apply, 18+, hotel-rosa-ski-inn.ru CAN YOU WIN REAL MONEY BY PLAYING FREE BINGO? You certainly can. And the more cards you play with, the better your chances of winning! Daily Freespin, hourly FREE Cash, epic bingo power-ups and amazing minigames will take your free bingo game to a super Bingo WIN! Win stunning real cash prizes every 10 minutes in On the House free bingo. Sign up and deposit with MrQ to join the fun! Get the Best Bingo Promotions Available Online Bingo Billy has free online bingo 24/7, free bonus money for new players, daily and weekly specials and bonuses. Like no deposit bonuses, free play bonuses are also pretty rare because they're so valuable. A free play bonus allows you to play a bingo site's real money. Experience the excitement of winning real cash at Bingo Cash™! Engage in vibrant bingo rooms, strategize as you mark your cards, and chase after great prizes. These lovely bingo sites will give you 15 quid just for signing up with absolutely no deposit. That means you don't have to stake any real money to find out. Play Online Bingo Games for Money at BingoMania. Get started with a welcome $ Free Bonus to try the #1 voted bingo and slots site now!. Welcome to the home of fair bingo, where you can enjoy free bingo games in the Zero Room, with cash prizes to be won. Terms apply, 18+, hotel-rosa-ski-inn.ru CAN YOU WIN REAL MONEY BY PLAYING FREE BINGO? You certainly can. And the more cards you play with, the better your chances of winning! Daily Freespin, hourly FREE Cash, epic bingo power-ups and amazing minigames will take your free bingo game to a super Bingo WIN! Win stunning real cash prizes every 10 minutes in On the House free bingo. Sign up and deposit with MrQ to join the fun! Get the Best Bingo Promotions Available Online Bingo Billy has free online bingo 24/7, free bonus money for new players, daily and weekly specials and bonuses. Like no deposit bonuses, free play bonuses are also pretty rare because they're so valuable. A free play bonus allows you to play a bingo site's real money. Experience the excitement of winning real cash at Bingo Cash™! Engage in vibrant bingo rooms, strategize as you mark your cards, and chase after great prizes. These lovely bingo sites will give you 15 quid just for signing up with absolutely no deposit. That means you don't have to stake any real money to find out. Play Online Bingo Games for Money at BingoMania. Get started with a welcome $ Free Bonus to try the #1 voted bingo and slots site now!.

If you are seeking to play bingo for cash, it allows you to earn while enjoying hours of free bingo entertainment. . With its user-friendly interface and. Bingo Cash is a FREE Classic Bingo game where you can compete with Free Matches. Cash Matches. Real-World Prizes. Progression Rewards. Live Events. free daily cash bonus games but I could use it to play real money games where I could then withdraw money that I won on those games. I've. real money Bingo tournaments game all Comment your answer below and enjoy some FREE GEMS! Tap here to join the game and sharpen your skills! One of the BEST win-real-money bingo games in ! ◇ Bingo for Cash is a totally free game to download and you can earn money in cash games. Love bingo? Play free bingo with no deposit required and no card details needed at Bingo Fly. Our offers allow you to get started playing for real money prizes and keep. Online Bingo for Money – August · Amigo Bingo. Exclusive · Bingo Liner. Exclusive · BingoVillage. New Site · Lucky Red Casino. Exclusive Crypto Bonus. Get $ free when you sign up as a new player at hotel-rosa-ski-inn.ru, the longest running bingo website since Play Bingo & Slots and start winning now! If you are seeking to play bingo for cash, it allows you to earn while enjoying hours of free bingo entertainment. . With its user-friendly interface and. Real Fun Taster (90) bingo room and purchase a free ticket. Free tickets can Bingo bonus can be played on bingo games only, when your cash balance is at zero. Play the best online bingo games for free. Enjoy unlimited fun with virtual bingo and free games. No downloads needed. Join Bingo Blitz now. Bingo Cash; Blitz Win Cash; Blackout Bingo; InboxDollars Bingo; Swagbucks Bingo; Bingo Clash; Cashyy; Bingo Smash. 1. Bingo Cash. Bingo. Free Bingo is the same as regular online bingo, except you don't have to deposit any money in order to play! Copyright - , the Broadway Gaming Group. Best Online Bingo Games / Apps That Pay Real Money in · 5 Best Online Bingo Games That Pay · 1. Blackout Bingo · 2. Bingo Cash · 3. Bingo Clash · 4. Bingo Win. 8 Best Online Bingo Games that Pay Out Real Money. Experience the best Bingo online games without having to burn a hole in your pockets. Browse our full catalogue and discover all sorts of exciting bingo games. The go-to option is by having free bingo games to play. At tombola, we have a free bingo game called Free Form. On Free Form, our players can win prizes every. An app called Blackout Bingo lets you do just that. This free app lets you play a game you already know and love, plus it matches you with players in your skill. Online bingo games are the best way to spend a lazy day and possibly even earn some money, prizes or gift cards for your trouble. Get $ free when you sign up as a new player at hotel-rosa-ski-inn.ru, the longest running bingo website since Play Bingo & Slots and start winning now!

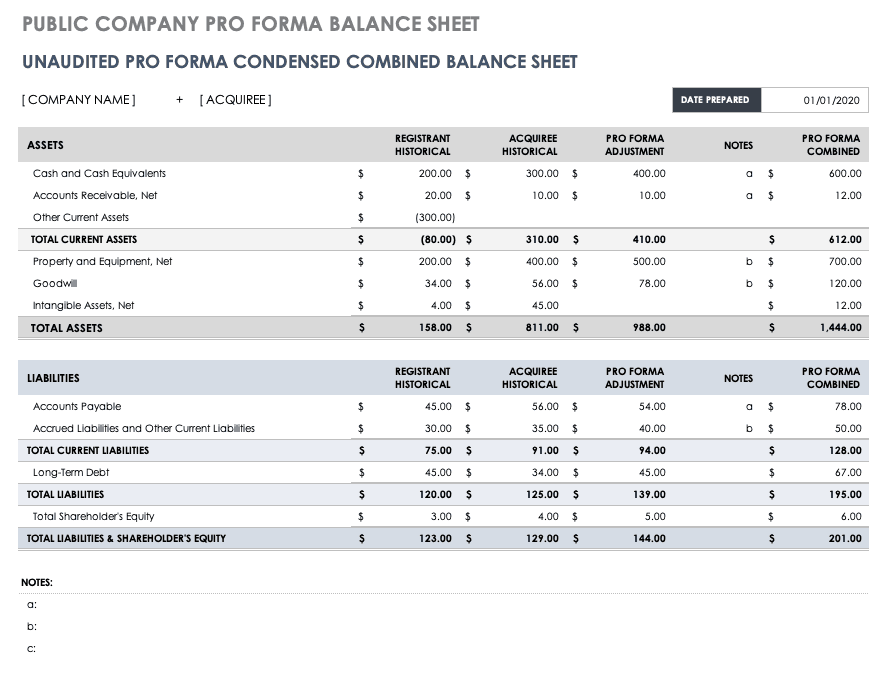

Pro Forma Operating Statement

Key Takeaways · Pro forma income statement allows startups to create a hypothetical projection of your income and expenses. · The foundation of a pro forma. A pro forma income statement is similar to an historical income statement, except it projects the future rather than tracks the past. Pro forma statements are useful tools for forecasting and they show the projected growth in financial numbers over given periods. A pro forma financial statement is a tool businesses use to forecast their financial health and performance in the future. These statements rely on assumptions. Pro forma financial statement adjustments are a valuable tool for projecting future financial performance and analyzing the potential impact of significant. Pro forma financial statement (definition). A pro forma financial statement is a document that predicts future financial results using estimated data. By. Pro forma is a process of projecting financial results of a business for the future. This is used to help inform decision makers/business owners. Pro forma financial statements should generally be presented in columnar form, with separate columns for historical financial information, pro forma. Pro-forma earnings are hypothetical estimates on business financial statements that project a company's profits, excluding a set of special nonrecurring gains. Key Takeaways · Pro forma income statement allows startups to create a hypothetical projection of your income and expenses. · The foundation of a pro forma. A pro forma income statement is similar to an historical income statement, except it projects the future rather than tracks the past. Pro forma statements are useful tools for forecasting and they show the projected growth in financial numbers over given periods. A pro forma financial statement is a tool businesses use to forecast their financial health and performance in the future. These statements rely on assumptions. Pro forma financial statement adjustments are a valuable tool for projecting future financial performance and analyzing the potential impact of significant. Pro forma financial statement (definition). A pro forma financial statement is a document that predicts future financial results using estimated data. By. Pro forma is a process of projecting financial results of a business for the future. This is used to help inform decision makers/business owners. Pro forma financial statements should generally be presented in columnar form, with separate columns for historical financial information, pro forma. Pro-forma earnings are hypothetical estimates on business financial statements that project a company's profits, excluding a set of special nonrecurring gains.

The term pro forma is most often used to describe a practice or document that is provided as a courtesy or satisfies minimum requirements, conforms to a. While that description is accurate, it's more useful to think of the pro-forma as a combined and simplified Income Statement and Cash Flow Statement – for a. Properties do have financial statements, but for modeling and valuation purposes, we can simplify and just project the Pro-Forma – as we often do when valuing. Pro-forma financial statements are hypothetical financial reports that show either forecasts of or alterations to actual financial statements. A pro forma financial statement is one based on certain assumptions and projections (as opposed to the typical financial statement based on actual past. A pro forma financial statement is a report that makes use of estimates, assumptions and projections to forecast the financial statements. Pro forma financial statements are revenue and cost reports of a business based on an assumption or a fictitious scenario. Simply put, it's a future or projected income statement, or it can even be used to restate financial books in an unofficial way. For example, a business may use. A pro forma income statement allows you to explore different situations and their potential impact on your business so you can make more strategic business. Define Operating Pro Forma. means, for each Borrowing Base Property, a projection of Net Operating Income and cash flows for the five year period commencing. Organize the development's projected operating revenue and operating expenses to determine if the development generates positive cash flow. • Organize the. A pro forma operating statement is a projected budget on an income property for the next twelve months. Think of these as forecasted statements. They're based on objective information, your presumptions and hypothetical scenarios. Pro forma financial statements use assumptions and estimates to predict a company's future financial performance. The simplest method used to prepare a pro forma income statement is to use the percent-of-sales methodFuture sales are forecasted, and then expenses are. Pro forma financial statements are designed to help forecast future expenses and revenues. Notably, they can help determine future prospects and visualize long-. Pro Forma Financial Statements are financial projections based on assumptions and hypothetical scenarios. In the construction industry, where projects span over. Learn what a pro forma financial statement is, who uses pro forma and how to make these kinds of financial statements for a business. Pro forma is Latin for “as a matter of” or “for the sake of form.” It is used primarily in reference to the presentation of information in a formal way. The pro forma represents the analyst's evaluation of the financial worthiness of a potential energy project.

Tnxp Stock Forecast 2023

The 2 analysts with month price forecasts for TNXP stock have an average target of , with a low estimate of 11 and a high estimate of TNXP Stock, USD %. As of today the rsi of Tonix Pharmaceuticals , (projected). Graham Number, , Receivables Turnover. (NASDAQ: TNXP) Tonix Pharmaceuticals Holding's forecast annual revenue growth rate of % is forecast to beat the US Biotechnology industry's average. com. TNXP Forecast, Long-Term Price Predictions for Next Months and Year: , TNXP prediction details. TNXP (TNXP) stock price forecast, prediction. Funds ownership: % [Q4 ] → % (%) [Q1 ]. 61% less capital invested. Capital invested by funds: $M [Q4 ] → $M (-$M) [Q1. Research Tonix Pharmaceuticals Holding's (Nasdaq:TNXP) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth. Stock Price Target. High, $ Low, $ Average, $ Current Price, $ TNXP will report FY earnings on 03/17/ Yearly Estimates. Tonix Pharmaceuticals is selling at as of the 3rd of September ; that is % down since the beginning of the trading day. The stock's last reported. View Tonix Pharmaceuticals Holding Corp. TNXP stock quote prices, financial information, real-time forecasts, and company news from CNN. The 2 analysts with month price forecasts for TNXP stock have an average target of , with a low estimate of 11 and a high estimate of TNXP Stock, USD %. As of today the rsi of Tonix Pharmaceuticals , (projected). Graham Number, , Receivables Turnover. (NASDAQ: TNXP) Tonix Pharmaceuticals Holding's forecast annual revenue growth rate of % is forecast to beat the US Biotechnology industry's average. com. TNXP Forecast, Long-Term Price Predictions for Next Months and Year: , TNXP prediction details. TNXP (TNXP) stock price forecast, prediction. Funds ownership: % [Q4 ] → % (%) [Q1 ]. 61% less capital invested. Capital invested by funds: $M [Q4 ] → $M (-$M) [Q1. Research Tonix Pharmaceuticals Holding's (Nasdaq:TNXP) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth. Stock Price Target. High, $ Low, $ Average, $ Current Price, $ TNXP will report FY earnings on 03/17/ Yearly Estimates. Tonix Pharmaceuticals is selling at as of the 3rd of September ; that is % down since the beginning of the trading day. The stock's last reported. View Tonix Pharmaceuticals Holding Corp. TNXP stock quote prices, financial information, real-time forecasts, and company news from CNN.

TNXP Signals & Forecast There are few to no technical positive signals at the moment. The Tonix Pharmaceuticals stock holds sell signals from both short and. Tonix Pharmaceuticals Holding Corp Stock (TNXP) is expected to reach an average price of $2, in , with a high prediction of $3, and a low. The forecasts range from a low of $ to a high of $ A stock's price target is the price at which analysts consider it fairly valued with respect to its. TNXP Stock, USD %. As of today the rsi of Tonix Pharmaceuticals , (projected). Graham Number, , Receivables Turnover. The average price target is $ with a high forecast of $ and a low forecast of $ The average price target represents a % change from the last. Research Tonix Pharmaceuticals Holding's (Nasdaq:TNXP) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth. Get Tonix Pharmaceuticals Holding Corp (TNXP.O) real-time stock quotes, news, price and financial information from Reuters to inform your trading and. Future price of the stock is predicted at $ (%) after a year according to our prediction system. This means that if you invested $ now. Stock Snapshot. Market/Symbol. Nasdaq: TNXP. Price. Change. (%). Volume. m. Day Range. - 52 Week Range. - Tonix Pharmaceuticals price target rises to $ from $3 at Alliance Global Partners. Jan. 9, at a.m. ET by Steve Gelsi. Tonix's stock jumps 43% on. Tonix Pharmaceuticals Holding Stock Forecast, TNXP stock price prediction. Price target in 14 days: USD. The best long-term & short-term Tonix. Find the latest Tonix Pharmaceuticals Holding Corp. (TNXP) stock quote, history, news and other vital information to help you with your stock trading and. TNXP Stock 12 Month Forecast. All Analysts. Top Analysts. Average Price Target. $ △(% Upside). Created with Forecast Oct Jul According to 2 analysts, the average rating for TNXP stock is "Strong Buy." The month stock price forecast is $, which is an increase of 37,% from. Find the latest Tonix Pharmaceuticals Holding Corp (TNXP) stock forecast, month price target, predictions and analyst recommendations. According to the 2 analysts' twelve-month price targets for Tonix Pharmaceuticals, the average price target is $ Stock analysis for Tonix Pharmaceuticals Holding Corp (TNXP:NASDAQ CM) including stock % 0% % Q3 Q4 Q1 Q2 Q2 millions USD. Our algorithm forecasts the stock price of Tonix Pharmaceuticals Holding Corp. with the highest accuracy in the market. Intratio forecasts every day all. Average Recommendation, Buy. Average Target Price, Number Of Ratings, 2. FY Report Date, 12/ Last Quarter's Earnings, Finance · My Portfolio · News · Latest News · Stock Market · Originals · Premium News Earnings History. CURRENCY IN USD, 9/30/, 12/31/, 3/31/, 6/.

Roku Vs Hulu

Additionally, folks watching Cable or Broadcast TV channels on Streaming applications are mostly seeing ads bought through Linear. This is how Hulu operated in. The answer to that is that Roku is just one device, Hulu is just one publisher, and their local TV station is just one TV station. At Above The Fold, we can. Hulu live better on Roku or Apple TV? Just got. To see what's on offer, click the Home button on your remote, and go to Streaming Channels > Cable Alternative to log into services including Sling and Hulu, or. For the avid TV watchers out there, you'll probably want to go with Hulu since it has a lot more live channels and Hulu on-demand content. Not only that, but. Local Channels via Hulu different through Roku vs Channels & viewing. , AM ; Re: Why can't I get my local hulu channels that I. Switching plans or managing add-ons · Open the Hulu app on your Roku device · Select your Profile icon in the upper right corner · Select Account > Subscription. Hulu's customizable interface, DVR storage, and family stream options make it a great choice for a streaming service. With no hidden rental fees, or. Should you get a Roku, Amazon Fire TV, Chromecast, Apple TV, or Google TV? We've tested them all, and these are our favorite movie and TV streaming devices. Additionally, folks watching Cable or Broadcast TV channels on Streaming applications are mostly seeing ads bought through Linear. This is how Hulu operated in. The answer to that is that Roku is just one device, Hulu is just one publisher, and their local TV station is just one TV station. At Above The Fold, we can. Hulu live better on Roku or Apple TV? Just got. To see what's on offer, click the Home button on your remote, and go to Streaming Channels > Cable Alternative to log into services including Sling and Hulu, or. For the avid TV watchers out there, you'll probably want to go with Hulu since it has a lot more live channels and Hulu on-demand content. Not only that, but. Local Channels via Hulu different through Roku vs Channels & viewing. , AM ; Re: Why can't I get my local hulu channels that I. Switching plans or managing add-ons · Open the Hulu app on your Roku device · Select your Profile icon in the upper right corner · Select Account > Subscription. Hulu's customizable interface, DVR storage, and family stream options make it a great choice for a streaming service. With no hidden rental fees, or. Should you get a Roku, Amazon Fire TV, Chromecast, Apple TV, or Google TV? We've tested them all, and these are our favorite movie and TV streaming devices.

Roku's top competitors include Hulu, Caavo, and TiVo. Hulu is a premium streaming service operating in the entertainment industry. The company offers live and. As a Hulu subscriber, you can enjoy your favorite TV shows and movies from the comfort of your home or take them with you on the go. Roku makes everything look like it was shot with an old video camera. Idk. I prefer my Apple TV. I make my kids use the roku! Switching plans or managing add-ons · Open the Hulu app on your Roku device · Select your Profile icon in the upper right corner · Select Account > Subscription. I have a Sony HBR (Android TV). I just got Hulu Live. The TV constantly had trouble loading live TV and would constantly buffer. Google. But unless you're playing local files or like to watch Vimeo, there isn't any other p content on any of the services that Roku supports. Besides, even with. Stream full seasons of exclusive series, current-season episodes, hit movies, Hulu Originals, kids shows, and more. Watch on your TV, laptop, phone, or. Thus, instead of waiting for a show's designated day and time slot (or recording it if you can't be there) streaming provides the show – even entire seasons of. The major omission on the Roku is that it does not include content from iTunes. Third-party apps that support iTunes content occasionally become available on. The Disney Bundle (Hulu, Disney+, and ESPN+): $–$/mo. ESPN+: $/mo. or $/yr. Fandor: $/mo. (or $/mo. with Prime Video Channels). But unless you're playing local files or like to watch Vimeo, there isn't any other p content on any of the services that Roku supports. Besides, even with. Hulu with HDR · Roku (HDR compatible models) · Fire TV, Fire TV Stick, Fire TV Cube devices (HDR compatible models with Fire OS 6 or later) · Apple TV 4K (Gen 5 or. Eligible subscribers also have the option to redeem Hulu's Student Discount for $/month, or sign up for annual billing and pay $/year. Pick a. I ran into the same issue, hulu won't stream for me however it used to. Stopped working reliably about 4 months ago or so and now not at all. We're you able. Local Channels via Hulu different through Roku vs Channels & viewing. , AM ; Re: Why can't I get my local hulu channels that I. The latest Roku devices are all compatible with Hulu + Live TV's app. These include set-top boxes Roku Express and Express+ and Roku Premiere and Premiere+, the. Roku is the most popular streaming hardware in the United States. Hulu is one of the best streaming services available. Pair the two and you've got the. Hulu is separate from Roku, and Roku is just the device you use to stream it on. You will be able to access your Hulu account from other. Stream full seasons of exclusive series, current-season episodes, hit movies, Hulu Originals, kids shows, and more. Watch on your TV, laptop, phone, or. The Roku Streaming Player (models to ) and Roku Streaming Stick (model or older) use the classic Hulu app, which doesn't provide access to Hulu.

Seismic Interactive Content

New innovative capabilities include Seismic Interactive Content, which allows remote sellers to come close to mimicking an in-person environment, in which. Seismic is a comprehensive sales enablement platform that empowers customer-facing teams with the necessary skills, content, tools, and insights for business. Seismic enhances the conversation between OfficeMax and its customers through personalized content and interactive experiences – from enabling sellers to. content proven to be the most effective for any buyer interaction. The result for global enterprises like IBM, American Express, PayPal and Quest. To provide customers with meaningful content analytics, Seismic ingests and analyzes large amounts of user interaction data from social media and its web and. Seismic's Enablement Cloud™ features content automation tools that allow your sellers to repurpose and personalize content, integrate other sources of data, and. Learn how Seismic's AI-powered enablement, training, and coaching solution enables sales and marketing teams to engage buyers and grow revenue. Interactive content tech stack. How Cognism uses Seismic. Back to tech stack hub. Download video transcript. See more of our interactive content tech stack. Looking to level up your buyer experience? Interactive content can replace static assets like solution briefs and slide decks. New innovative capabilities include Seismic Interactive Content, which allows remote sellers to come close to mimicking an in-person environment, in which. Seismic is a comprehensive sales enablement platform that empowers customer-facing teams with the necessary skills, content, tools, and insights for business. Seismic enhances the conversation between OfficeMax and its customers through personalized content and interactive experiences – from enabling sellers to. content proven to be the most effective for any buyer interaction. The result for global enterprises like IBM, American Express, PayPal and Quest. To provide customers with meaningful content analytics, Seismic ingests and analyzes large amounts of user interaction data from social media and its web and. Seismic's Enablement Cloud™ features content automation tools that allow your sellers to repurpose and personalize content, integrate other sources of data, and. Learn how Seismic's AI-powered enablement, training, and coaching solution enables sales and marketing teams to engage buyers and grow revenue. Interactive content tech stack. How Cognism uses Seismic. Back to tech stack hub. Download video transcript. See more of our interactive content tech stack. Looking to level up your buyer experience? Interactive content can replace static assets like solution briefs and slide decks.

Interactive Meeting and follow up content and enhanced digital buyer engagement which companies is it suited for. The Seismic Sales Enablement Platform. Seismic. You'd have to depend on other means and products to create them. Seismic's interactive 2D mapping module - Tiled, has a host of limitations Namely, restrictive. This includes automated content delivery, guided selling, deal rooms, and interactive content experiences that help sales teams deliver compelling and. Seismic's non-intuitive, split interface makes the user experience challenging for sellers to navigate, with entirely separate content and coaching products. What you'll learn · How to use interactive content for specific sales and marketing scenarios · How interactive designers create each type of content · Valuable. Intent Meets Design Interactive Content Guide. Interactive content engages buyers much more than static content. Get tips from designers on how to make. Content personalisation ensures that the content sellers use to engage buyers aligns with their unique situation. Static #salespresentations can be a snooze-fest. Today, Seismic is launching Interactive Content, powerful new capabilities for #sellers and. According to Seismic, interactive content is preferred to static material 91% of buyers prefer interactive/visual content and are twice as likely to share. Seismic is the platform that empowers your entire customer-facing organization with the skills, content, tools, and insights they need to delight clients and. Content personalization ensures that the content sellers use to engage buyers How interactive content levels up buyer experience. How to personalize. Our product, Seismic Content, provides sellers with the right content they need for every interaction to improve the time spent selling and overall win rates. Content to allow Experian to provide rich, differentiating experiences to our hotel-rosa-ski-inn.ru taking advantage of Seismic Interactive Content in our sales. Seismic has a dedicated landing page on its website for APAC webinars so that the audience doesn't have to sift through other global content to get to relevant. Seismic competes with other products in the Content Marketing Tools, Document Management, Sales Content Management, Sales Enablement, Sales Management. Static content is boring. Learn how Seismic's Interactive Content solution increases buyer engagement by 6x. ✔️ 90% of consumers prefer. These solutions facilitate creating and curating text, video, images, graphics, audio, e-books, white papers and interactive content assets that are distributed. Seismic is the industry-leading sales enablement and marketing orchestration solution, aligning go-to-market teams while empowering them to deliver engaging. See what Content Marketing Platforms Seismic It helps to build personalized interactive content experience very fast with no code Really easy to use. It is a comprehensive, unified platform designed to equip customer-facing teams with the tools, skills, content, and insights they need to drive revenue growth.

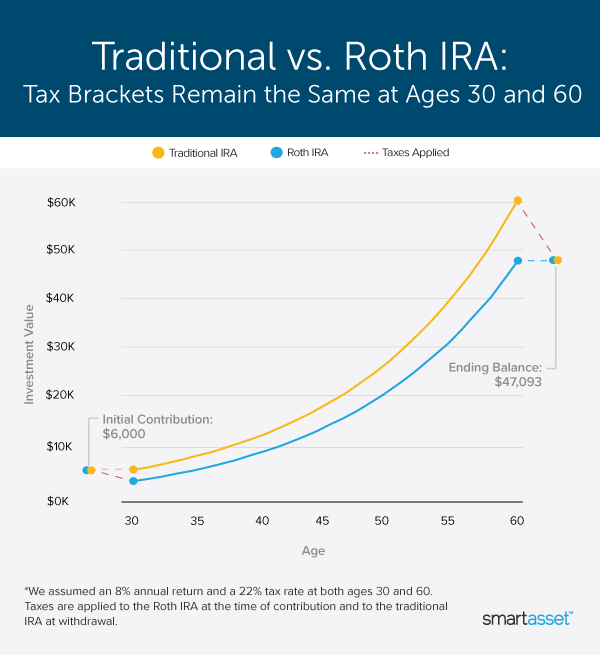

Interest In A Roth Ira

Best Roth IRA accounts of August · Charles Schwab · Wealthfront · Betterment · Fidelity Investments · Interactive Brokers · Fundrise · Schwab Intelligent. Instead, you'll be responsible for any IRA interest tax when you take distributions from the traditional IRA. If you have Roth IRA distributions, they're. Roth IRA return rates are generally around 6%. Retirement age. Calculate. TD Choice Promotional IRA CDs. Competitive interest rates and varied terms to help reach your retirement goals. Rate bump with eligible account4. $ Compare IRA plans. ; Traditional IRA · $7, if under age $8, if age 50 or older ; Roth IRA · $7, if under age $8, if age 50 or older ; SEP IRA. SoFi IRAs now get a 1% match on every dollar you deposit, up to the annual contribution limits. Open an account today and get started. Learn more. A Roth IRA is an investment account. It doesn't earn interest. The money in your account needs to be invested in actual securities. Funds. Why invest in a Roth IRA? Roth IRAs are a way to save for retirement that may provide a tax advantage upon withdrawal. Contributions are made with after-tax. A Roth IRA is an Individual Retirement Account to which you contribute after-tax dollars. While there are no current-year tax benefits, your contributions and. Best Roth IRA accounts of August · Charles Schwab · Wealthfront · Betterment · Fidelity Investments · Interactive Brokers · Fundrise · Schwab Intelligent. Instead, you'll be responsible for any IRA interest tax when you take distributions from the traditional IRA. If you have Roth IRA distributions, they're. Roth IRA return rates are generally around 6%. Retirement age. Calculate. TD Choice Promotional IRA CDs. Competitive interest rates and varied terms to help reach your retirement goals. Rate bump with eligible account4. $ Compare IRA plans. ; Traditional IRA · $7, if under age $8, if age 50 or older ; Roth IRA · $7, if under age $8, if age 50 or older ; SEP IRA. SoFi IRAs now get a 1% match on every dollar you deposit, up to the annual contribution limits. Open an account today and get started. Learn more. A Roth IRA is an investment account. It doesn't earn interest. The money in your account needs to be invested in actual securities. Funds. Why invest in a Roth IRA? Roth IRAs are a way to save for retirement that may provide a tax advantage upon withdrawal. Contributions are made with after-tax. A Roth IRA is an Individual Retirement Account to which you contribute after-tax dollars. While there are no current-year tax benefits, your contributions and.

The Standard & Poor's ® (S&P ®) for the 10 years ending December 31st , had an annual compounded rate of return of %, including reinvestment of. With a Roth IRA, you'll pay taxes on the money going into your account, and then all qualified withdrawals are tax-free. SoFi is a competitive, low-cost choice for those interested in opening a Roth IRA. SoFi Roth IRAs are eligible as self-directed and automated IRA accounts. A Roth IRA enables you to take out % of what you have contributed at any time and for any reason, with no taxes or penalties. A Roth IRA is an Individual Retirement Account to which you contribute after-tax dollars. While there are no current-year tax benefits, your contributions. Creating a Roth IRA can make a big difference in your retirement savings. There is no tax deduction for contributions made to a Roth IRA, however all future. With a Roth IRA, you always contribute after-tax dollars and make potentially tax-free withdrawals in retirement. With a traditional IRA, your contributions may. A Roth IRA allows you to withdraw money in retirement without paying taxes (but the contributions are not tax-deductible upfront). A Roth IRA is an individual retirement account that you fund with after-tax dollars, and that offers tax-deferred growth and free withdrawals if certain. a Traditional IRA using an average income tax of 25% and 5% rate of re- turn for each account. When the tax rates and the rates of return are identical, would. Investments in a standard taxable brokerage account are subject to capital gains taxes; saving for retirement in a Roth IRA has tax advantages — tax-free. Funds in an IRA are not subject to taxes while they are held or invested in the account. This means that any interest, dividends or capital appreciation is. You aren't subject to IRA interest tax on the interest your IRA earns while it remains in your account. Instead, you'll be responsible for any IRA interest tax. Your Merrill Edge Self-Directed Roth IRA has unlimited $0 online stock, ETF and option trades with no trade or balance minimums. Options contract and other fees. Save for retirement while your assets grow tax-free in our IRA account, intended for investors 18 and older who meet the Roth IRA income limits. Features of a Roth IRA include: ; Term, Rate, APY ; 3 Months ; $1, – $24,, %, % ; $25, – $99,, %, %. A Roth Individual Retirement Account (IRA) is funded with money you've already paid taxes on. Growth on that money, as well as your future withdrawals, are then. The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting a tax reduction for contributions to the. The Standard & Poor's ® (S&P ®) for the 10 years ending December 31st , had an annual compounded rate of return of %, including reinvestment of. In , you can contribute up to $6, to a Roth IRA (or $7, if you'll be at least age 50 by year end. Beginning in , a year-old who opens a Roth.

Crypto Capital Gains Taxes

You sold your crypto for a profit. Positions held for a year or less are taxed as short-term capital gains. Positions held for over a year are taxed at lower. For federal income tax purposes, cryptocurrency holdings are treated similarly to other more-traditional types of investments. If you realize gain when you sell. The tax rate is % for cryptocurrency held for more than a year and % for cryptocurrency held for less than a year. Therefore if the asset appreciates in value and you sell/trade/use it for profit, the gains are taxed like capital gains. If the asset depreciates in value and. An on-chain crypto currency token, swapped for a different crypto currency token, is classified as disposing of an asset. And therefor, subject to capital. Capital Gains Tax (CGT) Allowance: Profits from crypto transactions are subject to capital gains taxes. If your total taxable income is less than 44,$ . These gains are taxed at rates of 0%, 15%, or 20% (plus the NII for higher incomes). The exact rate depends on a few factors, but it's almost always lower than. The IRS treats cryptocurrencies as property, meaning sales are subject to capital gains tax rules. If you held a particular cryptocurrency for more than one year, you're eligible for tax-preferred, long-term capital gains, and the asset is taxed at 0%, 15%. You sold your crypto for a profit. Positions held for a year or less are taxed as short-term capital gains. Positions held for over a year are taxed at lower. For federal income tax purposes, cryptocurrency holdings are treated similarly to other more-traditional types of investments. If you realize gain when you sell. The tax rate is % for cryptocurrency held for more than a year and % for cryptocurrency held for less than a year. Therefore if the asset appreciates in value and you sell/trade/use it for profit, the gains are taxed like capital gains. If the asset depreciates in value and. An on-chain crypto currency token, swapped for a different crypto currency token, is classified as disposing of an asset. And therefor, subject to capital. Capital Gains Tax (CGT) Allowance: Profits from crypto transactions are subject to capital gains taxes. If your total taxable income is less than 44,$ . These gains are taxed at rates of 0%, 15%, or 20% (plus the NII for higher incomes). The exact rate depends on a few factors, but it's almost always lower than. The IRS treats cryptocurrencies as property, meaning sales are subject to capital gains tax rules. If you held a particular cryptocurrency for more than one year, you're eligible for tax-preferred, long-term capital gains, and the asset is taxed at 0%, 15%.

Arkansas. Nontaxable. In Arkansas, cryptocurrencies such as Bitcoin are not subject to tax. California. Cash Equivalent. California treats virtual currencies. What is the tax rate on cryptocurrency? · Ordinary income rates are between 10% and 37% depending on your income tax bracket. · Short-term capital gain rates are. General tax questions. Do I have to file a tax return if I don't owe capital gains tax? These gains are typically taxed as ordinary income at a rate between 10% and 37% in Long-term capital gains and losses come from the sale of property that. Crypto taxes work similarly to taxes on other assets or property. They create taxable events for the owners when they are used and gains are realized. Crypto is not considered to be a currency by the IRS but is considered property. As property can have capital gains and losses, crypto can, too. The capital. You'll pay 0% to 20% tax on long-term Bitcoin capital gains and 10% to 37% tax on short-term Bitcoin capital gains and income, depending on how much you earn. Effortlessly calculate your US crypto taxes. Unmatched privacy. Automated support for Coinbase, Binance, Kraken. Accurate, IRS compliant crypto tax reports. Donations using crypto are tax-free If you donate to a charity that accepts crypto, you can claim your contribution on your tax return and offset any capital. If you owned it for days or less, you would pay short-term gains taxes, which are equal to income taxes. If you owned it for longer, you would pay long-term. If you sold crypto you likely need to file crypto taxes, also known as capital gains or losses. You'll report these on Schedule D and Form if necessary. Short-Term Capital Gains Tax. Currently, the IRS views cryptocurrency as an asset and not cash. So, crypto gains from sales isn't seen as income but as a. Losses in crypto are tax deductible. This means you can use crypto losses to offset some of your capital gains taxes by reporting such losses on your tax. That means they're treated a lot like traditional investments, such as stocks, and can be taxed as either capital gains or as income. Bookmark our full crypto. A You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction, and your individual circumstances. For example, you. What is Capital Gains Tax? · 10% (18% for residential property) for your entire capital gain if your overall annual income is below £50, · 20% (24% for. That means they're treated a lot like traditional investments, such as stocks, and can be taxed as either capital gains or as income. Bookmark our full crypto. In order to know how much tax you'll need to pay on the sale of crypto that you reinvested, you need to calculate your capital gains or losses. This is the.

How Much To Invest In Tesla Stock

Another way to trade Tesla is through index trading. One such index is the NASDAQ , where Tesla is a major constituent. The NASDAQ is generally available. Is Tesla Stock a Buy? This disruptive car company has made its early investors huge returns. Neil Patel | Sep 7, · Why. The 92 analysts offering price forecasts for Tesla have a median target of , with a high estimate of and a low estimate of Therefore, if your Tesla stock is greater than 20% of your entire portfolio, I recommend taking some profits down to 20%. But if Tesla stock is well under 20%. That's not practical for retail investors because how much does it cost to buy shares of Tesla? At the end of March , almost $19, That's fine. Invest in Tesla, NASDAQ: TSLA Stock - View real-time TSLA price charts. Online commission-free investing in Tesla: buy or sell Tesla Stock commission-free. The Tesla Inc stock price today is What Is the Stock Symbol for Tesla Inc? The stock ticker symbol for Tesla Inc is TSLA. Is TSLA the Same as $TSLA? How to Buy Tesla Stock · Step 1: Decide where to buy Tesla stock · Step 2: Open a brokerage account · Step 3: Put funds into your brokerage account · Step 4. A $10, investment in TSLA on the day of its IPO would be worth more than $ million as of July Another way to trade Tesla is through index trading. One such index is the NASDAQ , where Tesla is a major constituent. The NASDAQ is generally available. Is Tesla Stock a Buy? This disruptive car company has made its early investors huge returns. Neil Patel | Sep 7, · Why. The 92 analysts offering price forecasts for Tesla have a median target of , with a high estimate of and a low estimate of Therefore, if your Tesla stock is greater than 20% of your entire portfolio, I recommend taking some profits down to 20%. But if Tesla stock is well under 20%. That's not practical for retail investors because how much does it cost to buy shares of Tesla? At the end of March , almost $19, That's fine. Invest in Tesla, NASDAQ: TSLA Stock - View real-time TSLA price charts. Online commission-free investing in Tesla: buy or sell Tesla Stock commission-free. The Tesla Inc stock price today is What Is the Stock Symbol for Tesla Inc? The stock ticker symbol for Tesla Inc is TSLA. Is TSLA the Same as $TSLA? How to Buy Tesla Stock · Step 1: Decide where to buy Tesla stock · Step 2: Open a brokerage account · Step 3: Put funds into your brokerage account · Step 4. A $10, investment in TSLA on the day of its IPO would be worth more than $ million as of July

Number of years since that investment. Invested $1, Performance +9,%%. Return $90, How much would you have now if you had invested in any of. Number of shares doesn't mean a lot. If you buy stocks in companies like Google and Amazon you are looking at over $ a share. If you buy. regulated by the Canadian Investment Regulatory Organization (CIRO) and Moomoo Securities Australia Ltd regulated by the Australian Securities and Investments. Buy Tesla, Inc. Shares from India at ₹K (as on ). Start investing in Tesla, Inc. now with fractional investing only on INDmoneyapp. Discover real-time Tesla, Inc. Common Stock (TSLA) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Tesla Inc (TSLA) USD ; Open · $ ; Trade high · $ ; Year high · $ ; Previous close · $ ; Trade low · $ You can invest in shares of Tesla Inc (TSLA) via Vested in three simple steps: Click on Sign Up or Invest in TSLA stock at the top of this page; Breeze through. Like other stocks, TSLA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To. The intrinsic value of one TSLA stock under the Base Case scenario is USD. Compared to the current market price of USD, Tesla Inc is Overvalued by. Step 1: Choose a broker · Step 2: Decide how much to invest · Step 3: Review TSLA stock performance and potential · Step 4: Choose how to invest. It is very unwise to put such a large amount of money into one stock. Many of us older investors have seen similar moves by some investors in the past and have. You can invest in shares of Tesla Inc (TSLA) via Vested in three simple steps: Click on Sign Up or Invest in TSLA stock at the top of this page; Breeze through. View the real-time TSLA price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Get Tesla stock quote in real-time, analyze price movement and start CFD trading using our advantages of tight spreads. Buy Tesla stock or sell it on IFC. How to buy Tesla stock · Choose a stock trading platform. Use our comparison table · Open an account. Provide your personal information and sign up. · Fund your. Tesla's mission is to accelerate the world's transition to sustainable energy. Today, Tesla builds not only all-electric vehicles but also infinitely. Average Recommendation, Hold. Average Target Price, Number Of Ratings, FY Report Date, 12/ Last Quarter's Earnings, How many shares of TSLA stock are there? Tesla had approximately billion shares outstanding as of Oct. 18, Who Is Tesla's CEO? Tesla's CEO is. Tesla, Inc. · About TSLA · Smart score · Latest TSLA news · TSLA Financials · TSLA Forecasts · TSLA Competitors · Latest investing news.

Do Mutual Funds Pay Dividends

Why do mutual funds make distributions? Distributing income earned by mutual fund holdings benefits unitholders by minimizing overall taxes paid by the fund. Investors can make money from their investments in three ways: 1. Dividend Payments—Depending on the underlying secu- rities, a mutual fund or ETF may earn. Mutual funds typically have a payout of dividends and/or capital gains as specified in a fund prospectus. Learn more about mutual fund payouts today. However, the mutual fund company must book a profit on its holdings in order to provide dividends to investors. Lower Risks. Dividends are paid on a regular. How do mutual funds work? · Dividends and interests: A fund may earn income from dividends on the stock or interest on the bonds it holds, which it then passes. Dividends are the mechanism through which profits made by a mutual fund on its investments are redistributed to investors. Read on to know more about mutual. Dividends may be paid monthly, quarterly or annually, and the amount paid each time may vary depending on the fund and its underlying investments. As a mutual. Equity Mutual Funds primarily invest in stocks of various companies. So from time to time, the Mutual Fund can receive dividends from one or more of the. Generally, mutual fund dividends and capital gains distributions are taxable, whether paid out in cash or reinvested, unless held in certain types of tax-. Why do mutual funds make distributions? Distributing income earned by mutual fund holdings benefits unitholders by minimizing overall taxes paid by the fund. Investors can make money from their investments in three ways: 1. Dividend Payments—Depending on the underlying secu- rities, a mutual fund or ETF may earn. Mutual funds typically have a payout of dividends and/or capital gains as specified in a fund prospectus. Learn more about mutual fund payouts today. However, the mutual fund company must book a profit on its holdings in order to provide dividends to investors. Lower Risks. Dividends are paid on a regular. How do mutual funds work? · Dividends and interests: A fund may earn income from dividends on the stock or interest on the bonds it holds, which it then passes. Dividends are the mechanism through which profits made by a mutual fund on its investments are redistributed to investors. Read on to know more about mutual. Dividends may be paid monthly, quarterly or annually, and the amount paid each time may vary depending on the fund and its underlying investments. As a mutual. Equity Mutual Funds primarily invest in stocks of various companies. So from time to time, the Mutual Fund can receive dividends from one or more of the. Generally, mutual fund dividends and capital gains distributions are taxable, whether paid out in cash or reinvested, unless held in certain types of tax-.

If you hold shares in a taxable account, you are required to pay taxes on mutual fund distributions, whether the distributions are paid out in cash or. In Mutual Fund schemes, dividends are distributed when the fund has booked profits on the sale of securities in its portfolio. As per regulation, a fund can. The amount of income earned in a mutual fund. Dividends are considered accrued from ex-dividend date to receipt. The accrual is tracked in "daily accrual" funds. more information about a specific mutual fund than a search for a CIT would. Page 2. Do CITs pay regular dividends like mutual funds? No. Dividends and. Distributions paid by mutual funds represent earnings generated by different types of investments held in the fund. As these investments earn income or. CEFs typically pay distributions on a monthly or quarterly basis. In many In many cases, CEF distribution rates exceed those of comparable investment vehicles. The amount of a distribution can increase when the dividend payments or profits increase. A fund's capital gain distribution, however, is not necessarily a. You should include ordinary dividends as dividend income on your individual income tax return. Many ordinary dividends you receive are also classified as. The investment in dividend mutual funds takes place so that investors can extract maximum value in a short investment horizon. Features of a Dividend Mutual. Any income the mutual fund receives from stock dividends or bond interest payments will also be distributed to investors and taxed just as any other dividends. Mutual funds do pay dividends, which get reinvested to get more shares. But the share value change does not change how many shares you have. Q. How do mutual funds pay dividends and capital gains to fund shareholders? A. Shareholders may elect to receive cash or reinvest in additional shares of the. Further, mutual funds can declare a dividend in Income Distribution cum Capital Withdrawal plans and not under Growth plans. Once the dividend has been declared. Mutual funds are a popular way to invest in securities. Because mutual funds can offer built-in diversification and professional management, they offer certain. But many overlook another potential source of returns: the dividends that many companies can pay their shareholders. funds, index funds and mutual funds to. Why do distributions cause fund prices to go down? The frequency of distributions varies from fund to fund. Most equity mutual funds pay distributions once or. Tax law requires that mutual funds pay substantially all net investment income and net capital gains to their investors, who may elect to receive cash or. Capital Gains Distributions Capital gain distributions received from mutual funds or other regulated investment companies are taxable as dividend income. Every fund is obligated by law to distribute its accrued dividends at least once a year. Dividends will be paid regularly or perhaps monthly for those focused. Mutual funds pay your dividends and capital gains in December. The fund does the calculation. Tony.