hotel-rosa-ski-inn.ru Tools

Tools

Gobank Atm Limit

:max_bytes(150000):strip_icc()/atm-limits-315462_FINAL_HL-c926d176c7f44437be0694b917bbb6f8.jpg)

Otherwise $5 per month. See app for free ATM locations. $3 for out-of-network withdrawals, plus any additional fees the ATM owner or bank may charge. Limits. Quickly and securely login to your account with fingerprint touch ID or a personal identification number (PIN) of your choice. Branch and ATM Locations. easy. Cash deposits are limited to $2, per day and $3, per 30 days, subject to a maximum account balance of $50, GETTING CASH, FEE. In-Network ATM. You can download the GoBank application from the App Store on your iPhone or Android device. How do I view account balances, view transaction history, or. You may withdraw up to $ per day using your GO2bank debit card, provided you have funds available in your account. See your Deposit Account Agreement for. I've been with GoBank for years and switched over to GO2bank. Once you reach the ATM limit, you may go inside most banks and request a teller cash withdrawal. Fees and daily withdrawal limits apply. The maximum you can withdraw from ATMs is $2, per day and up to $10, from ATMs in a calendar month. Your daily. GoBank, Green Dot Bank, and Bonneville Bank. All of these addition to our limits, an ATM owner or operator may impose additional withdrawal limits. further limit your use of the Card at ATMs, and, in addition to our limits, an ATM owner or operator may impose additional withdrawal limits. We may refuse. Otherwise $5 per month. See app for free ATM locations. $3 for out-of-network withdrawals, plus any additional fees the ATM owner or bank may charge. Limits. Quickly and securely login to your account with fingerprint touch ID or a personal identification number (PIN) of your choice. Branch and ATM Locations. easy. Cash deposits are limited to $2, per day and $3, per 30 days, subject to a maximum account balance of $50, GETTING CASH, FEE. In-Network ATM. You can download the GoBank application from the App Store on your iPhone or Android device. How do I view account balances, view transaction history, or. You may withdraw up to $ per day using your GO2bank debit card, provided you have funds available in your account. See your Deposit Account Agreement for. I've been with GoBank for years and switched over to GO2bank. Once you reach the ATM limit, you may go inside most banks and request a teller cash withdrawal. Fees and daily withdrawal limits apply. The maximum you can withdraw from ATMs is $2, per day and up to $10, from ATMs in a calendar month. Your daily. GoBank, Green Dot Bank, and Bonneville Bank. All of these addition to our limits, an ATM owner or operator may impose additional withdrawal limits. further limit your use of the Card at ATMs, and, in addition to our limits, an ATM owner or operator may impose additional withdrawal limits. We may refuse.

withdrawal, and for replacing the card, as shown in the following table. ATM Transaction Fees. ATM withdrawal out-of-network (in the U.S), $ per transaction. What to check before I dispute a transaction · Pending transactions occur when a payment has been authorized but hasn't been completed. · A pending transaction. Withdrawal via ATM is one of the easiest ways of transaction of money. Transaction limit is the max amount of money which you can withdraw or. What's the most cash i can withdraw each day? You may only withdraw up to $ from ATMs in a single day. $3 for out-of-network withdrawals and $ for balance inquiries, plus any fee the ATM owner may charge. Limits apply. ***Fee of up to $ may apply. Cash deposits are limited to $2, per day and $3, per 30 days, subject to a maximum account balance of $50, GETTING CASH, FEE. In-Network ATM. ATM owner may also charge a fee. ATM limits apply. serve(R). Serve®. Flexibility That Works for You. Serve is made with you in mind, with flexible options to. The monthly limit is $3, over a rolling 30 days timeframe. Once you reach the ATM limit, you may also go inside most banks and request a teller cash. Find the Nearest ATM. The Way2Go® cardholders can get cash from ATMs worldwide wherever the MasterCard® acceptance mark is displayed. Some ATM owners apply a. Daily spending limit applies, $ per day cash limit, $2, per day point of sale. WHY WASN'T I ABLE TO TRANSFER FUNDS FROM MY GO BANK ACCOUNT TO AN EXTERNAL ACCOUNT? There are limits to how much you can transfer to another account from your. You now have 8 free monthly ATM withdrawals within the GoBank ATM network, afterwards a $ will apply. For Out-of-network ATM withdrawals, a. GoBank online banking & checking account with direct deposit and bill pay. Free ATM network of +. Open your account now! If your ATM limit is exceeded, you still have your bank Teller withdrawal limit available apart from ATM withdraw limit which is $ a day or. Specific info like transaction details, account numbers and ATM PINs over email. Lock it up. Don't write your ATM PIN on your debit card, and make sure to keep. Keep more of your money with no minimum balances, overdraft charges, or monthly fees with the Uber Debit Card by GoBank. Learn more and sign up here! You are allowed to make up to three cash withdrawals from an ATM per day. You may withdraw up to a maximum of $ per day, as long as you have sufficient. discretion, further limit your use of the Card at ATMs, and, in addition to our limits, an. ATM owner or operator may impose additional withdrawal limits. In. Spending and Card Limits · Point-of-Sale Limit: $3, per day · ATM Withdrawal Limit: $ (Account Owners can customize limits for cardholders) · Total Card Load. Once funds are loaded to your card, you can begin using it. Subject to transaction fees and limits; please see the Cardholder Agreement. On-demand pay1.

Ordinary Income Vs Capital Gains

They are typically taxed at ordinary income tax rates, as high as 37% in and Long-term gains come from the sale of assets you have owned for more. "Can you explain how long-term capital gains are 'stacked on top' of ordinary income?" Here are all the YMYW capital gains tax vs. ordinary income tax. Long-term capital gains are taxed at a rate lower than ordinary income, though there is no guarantee that future tax law changes won't change this fact. If an asset is sold within a year or less of its purchase, it's considered a short-term capital gain and is taxed at the same rate as your ordinary income. The distinction between ordinary income and capital gain is fundamental to our income tax system. Capital gain tax rate preferences in both magnitude and extent. The proceeds would be taxed at the long-term capital gains rate, which is lower than the tax rate for short-term capital gains, which is taxed at ordinary. The Federal tax code currently has one “loophole” on capital gains taxes that applies to lower earners. If someone's combined income—ordinary income plus. If an asset was held for less than one year and then sold for a profit, it is classified as a short-term capital gain and taxed as ordinary income. If an asset. Under current law, the tax rate for corporate capital gain is the same as ordinary income. For dispositions of personal property and certain non-residential. They are typically taxed at ordinary income tax rates, as high as 37% in and Long-term gains come from the sale of assets you have owned for more. "Can you explain how long-term capital gains are 'stacked on top' of ordinary income?" Here are all the YMYW capital gains tax vs. ordinary income tax. Long-term capital gains are taxed at a rate lower than ordinary income, though there is no guarantee that future tax law changes won't change this fact. If an asset is sold within a year or less of its purchase, it's considered a short-term capital gain and is taxed at the same rate as your ordinary income. The distinction between ordinary income and capital gain is fundamental to our income tax system. Capital gain tax rate preferences in both magnitude and extent. The proceeds would be taxed at the long-term capital gains rate, which is lower than the tax rate for short-term capital gains, which is taxed at ordinary. The Federal tax code currently has one “loophole” on capital gains taxes that applies to lower earners. If someone's combined income—ordinary income plus. If an asset was held for less than one year and then sold for a profit, it is classified as a short-term capital gain and taxed as ordinary income. If an asset. Under current law, the tax rate for corporate capital gain is the same as ordinary income. For dispositions of personal property and certain non-residential.

Short-term capital gains are still taxed at your ordinary income tax rate. ordinary income tax rates, not at capital gains tax rates).2 The main. Short-term capital gains are profits from selling assets you own for a year or less. They're usually taxed at ordinary income tax rates (10%, 12%, 22%, 24%, 32%. From a tax perspective, sellers may prefer a stock sale because the gain on the sale will likely be taxed as long-term capital gains at a top current federal. Up to $3, per year of capital losses can be deducted from ordinary income; losses over $3, are carried forward to future tax years. Losses on personal use. The return is taxed at either the capital gains tax rate if the asset was held for more than a year before being sold or at the ordinary income tax level if. For purposes of this subtitle, the term “ordinary income” includes any gain from the sale or exchange of property which is neither a capital asset nor. The ordinary income of an individual taxpayer is taxed at progressive rates of 10%, 15%, 25%, 33% and 35%. Long-term capital assets held for a year and a day. From fully-taxed interest income and foreign dividends, to preferably-taxed Canadian dividends and half-taxed capital gains, the type of investment income that. There are two types of capital gains: short-term and long-term. A short-term capital gain is the profit you receive from selling an item you kept for 12 months. If you have a net capital gain, that gain may be taxed at a lower tax rate than the ordinary income tax rates. The term "net capital gain" means the amount by. Gains on art and collectibles are taxed at ordinary income tax rates up to a maximum rate of 28 percent. Up to $, ($, for married couples) of. Generally, the Investment Income Tax for capital gains is 10%. Argentina Gains on transfers of other assets are taxable as ordinary income. NA. When an asset is sold for a profit, Uncle Sam wants his share. Depending on your income level, your capital gains rate might be lower than your ordinary tax. Just like with your wages and other ordinary income, the rate at which you're taxed on long-term capital gains depends on whether your taxable income is above. $62k of capital gain sits "on top" of the ordinary income. It spans from $10k to $72k, all of which falls in the 0% bracket. There is no tax on the long-term. Capital property is defined in section 54 of the Income Tax Act (Canada) (“ITA”) to include depreciable property and any property that results in a capital gain. Short-term capital gains are taxed at your marginal tax rate as ordinary income. The top marginal federal tax rate on ordinary income is 37%. For those. Taxable income is then run through the ordinary income tax brackets. Next, to determine which capital gains bracket to apply, long-term capital gains are added. In the United States, individuals and corporations pay a tax on the net total of all their capital gains. The tax rate depends on both the investor's tax. If you have a net capital gain, that gain may be taxed at a lower tax rate than the ordinary income tax rates. The term "net capital gain" means the amount by.

Web Development Diplomas

Typical web developer degree courses include principles of programming, database management systems, website and e-commerce strategies, and advanced web markup. A web developer combines web programming (how a website functions) with web design (how it looks). You will use a variety of tools to create websites, including. On this course from the Raspberry Pi Foundation, you'll first build a website using HTML, style it with CSS, and then make it interactive using JavaScript. The goal of the AS degree in Web Development is to provide students with the broad educational background required to transfer to a four-year school in a. Web development courses at Codecademy helps you master HTML, CSS, JavaScript, React, and more. Learn to build web apps and websites. First Steps at TSTC section First Year Seminar Courses (TSTC and TSTC ). Search Degree Plans: Campus Location. Degree Options for Aspiring Web Developers · Bachelor of Science in Computer Science · Bachelor's in Web Design, Web Development, or Interactive Media. This certificate provides students with the skills and knowledge needed to excel in the rapidly growing field of website and web application development. Learn how to build websites entirely online, through online coding boot camps, web developer certifications, or web development courses online. Typical web developer degree courses include principles of programming, database management systems, website and e-commerce strategies, and advanced web markup. A web developer combines web programming (how a website functions) with web design (how it looks). You will use a variety of tools to create websites, including. On this course from the Raspberry Pi Foundation, you'll first build a website using HTML, style it with CSS, and then make it interactive using JavaScript. The goal of the AS degree in Web Development is to provide students with the broad educational background required to transfer to a four-year school in a. Web development courses at Codecademy helps you master HTML, CSS, JavaScript, React, and more. Learn to build web apps and websites. First Steps at TSTC section First Year Seminar Courses (TSTC and TSTC ). Search Degree Plans: Campus Location. Degree Options for Aspiring Web Developers · Bachelor of Science in Computer Science · Bachelor's in Web Design, Web Development, or Interactive Media. This certificate provides students with the skills and knowledge needed to excel in the rapidly growing field of website and web application development. Learn how to build websites entirely online, through online coding boot camps, web developer certifications, or web development courses online.

In summary, here are 10 of our most popular full stack web development courses · IBM Full Stack Software Developer: IBM · IBM Full-Stack JavaScript Developer. Web Development Specialist Certificate - St. Petersburg College. Our Web Development Certificate gives you a foundation in the basic Web technologies of. Web Development Courses Online. Explore Web Development courses that cover skills in HTML, CSS, JavaScript, and responsive design. Build expertise for careers. Learn Web Development. The Web Development Specialist Technical Diploma introduces you to the principles of programming and web application development by. Web Development Courses · CS Introduction to Computer Science · CS50's Introduction to Programming with Scratch · CS50's Web Programming with Python and. The Certificate of Completion (CCL) in Web Development prepares students to create and administer interactive and professional websites. In summary, here are 10 of our most popular full stack web development courses · IBM Full Stack Software Developer: IBM · IBM Full-Stack JavaScript Developer. Online courses for building websites from scratch using popular tools and languages like HTML, CSS, Python, JavaScript, and more. Montco's Web Development and Design Associate of Applied Science degree program gives you the marketable skills to stand out from the pack online. Arizona State University's Bachelor of Science in graphic information technology with a concentration in full-stack web development allows you to explore both. eCornell's Web Design & Development certificate is all about designing and building websites that are focused on the needs of users. Enroll today! This program prepares you for a career in a growing field that guides organizations' web presence to convert leads, build brand awareness and more. NCC's Web Development associate degree and Web Design diploma program prepare students to kickstart a rewarding career in tech upon graduation. Learn more! We've ranked the best online bachelor's in web development programs. Learn about courses, costs, admission requirements, and career opportunities. Earn a web development degree with full stack experience and an impressive portfolio. Front-end web design and coding. Back-end server scripting and database. Design the future with DU's Web Design & Development Certificate. Master web and mobile app creation with user-centered design and programming skills. Full Sail University's Web Development Bachelor's Degree teaches the tools and technology needed to design and create interactive web content. Gain the skills and knowledge you need to create stunning websites with ABM College's Web Design & Development Diploma Online Certificate Program. The Website Development and Design degree is a sequence of courses designed to provide students with an understanding of the concepts, principles, and. Full-Stack Web Development prepares students for web programming and design incorporating computer science, art, English and business.

Cost To Move A Light Fixture

The cost to install lighting is typically $ per fixture, including labor and materials, according to Yelp data. But project costs can range from $– Delicate chandeliers need special attention, typically requiring packing peanuts, bubble wrap, and moving blankets to secure them for transport or storage. The basic cost to Install a Ceiling Light Fixture is $ - $ per fixture in April , but can vary significantly with site conditions and options. On average, it costs somewhere between $$1, to move a plumbing fixture around three feet or more. This varies, of course, depending on if your plumber. Pendants can only support a very lightweight bulb and shade – fittings over 2 kg must be chain supported. Fittings with metal parts must be earthed with a three. The total cost of supplies for this DIY = $20 dollah bills. Watch my DIY video tutorial or have a look at the instructions below. LET'S GO, YO!!! And remember. Installing most fixtures ranges from $$ The cost will be affected by the type of fixture selected and the condition of your wiring. In Maryland the price range is $$ per light. The installation cost will vary depending on the type of light, ceiling height, and ceiling finish. Most. Light fixtures are important elements in any home. Find out how much it costs to install a light fixture based on factors like type, location, and labor. The cost to install lighting is typically $ per fixture, including labor and materials, according to Yelp data. But project costs can range from $– Delicate chandeliers need special attention, typically requiring packing peanuts, bubble wrap, and moving blankets to secure them for transport or storage. The basic cost to Install a Ceiling Light Fixture is $ - $ per fixture in April , but can vary significantly with site conditions and options. On average, it costs somewhere between $$1, to move a plumbing fixture around three feet or more. This varies, of course, depending on if your plumber. Pendants can only support a very lightweight bulb and shade – fittings over 2 kg must be chain supported. Fittings with metal parts must be earthed with a three. The total cost of supplies for this DIY = $20 dollah bills. Watch my DIY video tutorial or have a look at the instructions below. LET'S GO, YO!!! And remember. Installing most fixtures ranges from $$ The cost will be affected by the type of fixture selected and the condition of your wiring. In Maryland the price range is $$ per light. The installation cost will vary depending on the type of light, ceiling height, and ceiling finish. Most. Light fixtures are important elements in any home. Find out how much it costs to install a light fixture based on factors like type, location, and labor.

You can save money on this project if you decide not to include light fixtures and other fixed appliances in your installation. If you opt to get new wiring for. fixture. Turnkey. Enjoy hassle-free installation and service. Little or no installation cost. Free up capital for other projects. Design services included. A journeyman or an apprentice electrician may charge you anywhere from $ to $ to install the light fixtures, depending on the number of lights and. Light fixtures are generally attached to the electrical box using bolts or screws. First, loosen the hardware holding your fixture into place (Image 1). It. The basic cost to Install a Lighting Fixture is $ - $ per fixture in April , but can vary significantly with site conditions and options. The Handy platform puts you in charge of when you book your electrical services. Whether you need a residential electrician tomorrow or an electrical contractor. Indoor lighting and electricity for commercial buildings cost $$ per square foot on average. SoundSwitch DMX lighting software for DJs. SoundSwitch allows users to control DMX and Philups HUE lighting using their DJ software and hardware including. Sometimes it is possible to retrofit only the new LED lamps into the existing lighting fixtures, which can reduce the cost greatly. This is not always the case. The average homeowner spends $ installing light fixtures, with most jobs costing between $ and $1, A single fixture installation could cost as little. How Hard Can It Be? Moving a Ceiling Light Fixture · Grounding – Returns electricity to the circuit breaker where it is then channeled to an outside rod · Hot –. Moving Lights. Home · Lighting & Theatrical · Lighting Fixtures; Moving Lights. Labor Cost. If you are going for professional light installation services, you need to pay around $35 to $ hourly to the electricians. And in most cases, it. cost solution for moving a light fixture without the dreaded plaster patching! First, have an electrician move the junction box so that it's centered over. The cost for the fixture itself can run anywhere from $20 for a simple option to $1, or more for a chandelier. Your electrician can address how the features. On average, recessed lighting costs $ per bulb. The cost of your project depends on numerous factors including the number of lights needed, your ceiling. The average cost to install outdoor lighting is about $ (12 hardscape lights and eight LED step lights installed). Find here detailed information about. costs, deciding to select a canopy light fixture is a wise move. Conclusion. You only need to look at canopy light fixtures if you're looking for a. It also includes setting up light fixtures and appliance electrical wiring but does not include the fixture or appliance costs. Costs depend on the electrical.

How To Remove Moldy Smell From House

We've put together a checklist to help you identify the cause of that musty smell, with help from Air Wick Aerosols. In contrast, those tools would only mask (not solve) musty basement smells and may lead you into a false sense of health safety. Can Musty Smells Affect My. How to get rid of musty smells in your home · Sweep, mop, vacuum, repeat. · Spot treat your carpets with baking soda. · Steam clean your carpets · Deep clean. Keep the House Clean The best way to eliminate odors in the winter is to keep your home clean. As you're stuck indoors a lot more when it's cold out, it's. If you are on a budget, musty smells can be absorbed by setting out an open container or baking soda, white vinegar, even cat litter. Heck, even. STAR BRITE NosGuard SG Mildew Odor Control Bag - Fast Release System - Ideal for Seasonal Homes & Cabins + Boat, RV & Vehicles Coming Out of Storage -. Learn more about dealing with that musty smell: hotel-rosa-ski-inn.ru If you have a musty odor in your. Often, a musty smell is simply a symptom of a more pressing issue, usually mold or mildew caused by moisture. Some of the most common areas where moisture. Charcoal bags or baking soda naturally absorb odors. Placing these around the home or in cupboards can absorb unwanted smells. Replace them often in the. We've put together a checklist to help you identify the cause of that musty smell, with help from Air Wick Aerosols. In contrast, those tools would only mask (not solve) musty basement smells and may lead you into a false sense of health safety. Can Musty Smells Affect My. How to get rid of musty smells in your home · Sweep, mop, vacuum, repeat. · Spot treat your carpets with baking soda. · Steam clean your carpets · Deep clean. Keep the House Clean The best way to eliminate odors in the winter is to keep your home clean. As you're stuck indoors a lot more when it's cold out, it's. If you are on a budget, musty smells can be absorbed by setting out an open container or baking soda, white vinegar, even cat litter. Heck, even. STAR BRITE NosGuard SG Mildew Odor Control Bag - Fast Release System - Ideal for Seasonal Homes & Cabins + Boat, RV & Vehicles Coming Out of Storage -. Learn more about dealing with that musty smell: hotel-rosa-ski-inn.ru If you have a musty odor in your. Often, a musty smell is simply a symptom of a more pressing issue, usually mold or mildew caused by moisture. Some of the most common areas where moisture. Charcoal bags or baking soda naturally absorb odors. Placing these around the home or in cupboards can absorb unwanted smells. Replace them often in the.

Kill the musty smell by washing and changing your sheets and covers at least once each week. And don't forget to wash your pillows – they harbor oils, germs. A common source of a musty smell in your home is a clogged or old HVAC filter. As an air filter ages, microscopic particles can build up and decrease its. Musty Smell Removal Supplies: · Charcoal odour & moisture absorbers (I swear by these!) · dehumidifier · kitty litter · sunshine! (clothesline and clothespegs help. How can I remove musty odors from my home? · Ventilation: Ensure good ventilation by opening windows and doors and airing the room frequently. · Check humidity. A musty odor takes time to develop: it is most often caused by dampness, mold or mildew, and signals some degree of decay. Use hydrogen peroxide to remove the moldy smell. Use carpet shampoo to remove the musty odor. Repeat the process. Unfortunately, mold or mildew growth from moisture in the air may be the root cause of the smell. As mold grows inside return air ducts, the air flowing through. the vinegar smell fades. Just put it somewhere no one will bump it. I use this all the time in a cup or glass to get rid of odors in my house. It's chemical. Also, a musty smell is among the early signs of mold infestation in your home. You'll start to smell it within 24 hours after mold spores have started to form. Kill the musty smell by washing and changing your sheets and covers at least once each week. And don't forget to wash your pillows – they harbor oils, germs. Below, we have steps and helpful tips to help you remove musty mold and mildew smells in your bathroom, laundry and basement on your own. Tips for Geting Rid of Musty Smells in Your Home · 1) Empty wardrobes and ensure each item of clothing has been throughly washed before being put back in. · 2). If the house smells musty after a big rain, you very likely have a moisture problem in the crawl space. The good news is that most smells can be removed. After baking soda, vinegar is the next best thing to get rid of musty smells from your rug. Another great benefit of vinegar is that it will kill mould spores. Mold Remediation for Documents and Books · Dry out a damp book by standing it upright on a table and gently fanning out the pages. · With the pages fanned out. smell. Find out how vinegar evaporates and absorbs odors with help from a professional house cleaner in this free video on mildew odors and. Mold is often described as smelling musty. Others have described mold as having an earthy or meaty odor, resembling the smell of wet socks or rotten wood. One of the easiest ways to remove a musty attic smell is to clean and deodorize the space. Sweep or vacuum the floors, and wipe down any surfaces with a mild. There are several reasons you may notice a musty smell in your house, but the most common cause is the presence of mold and moisture accumulation. When mold. A common source of a musty smell in your home is a clogged or old HVAC filter. As an air filter ages, microscopic particles can build up and decrease its.

When Is An S Corp Better Than An Llc

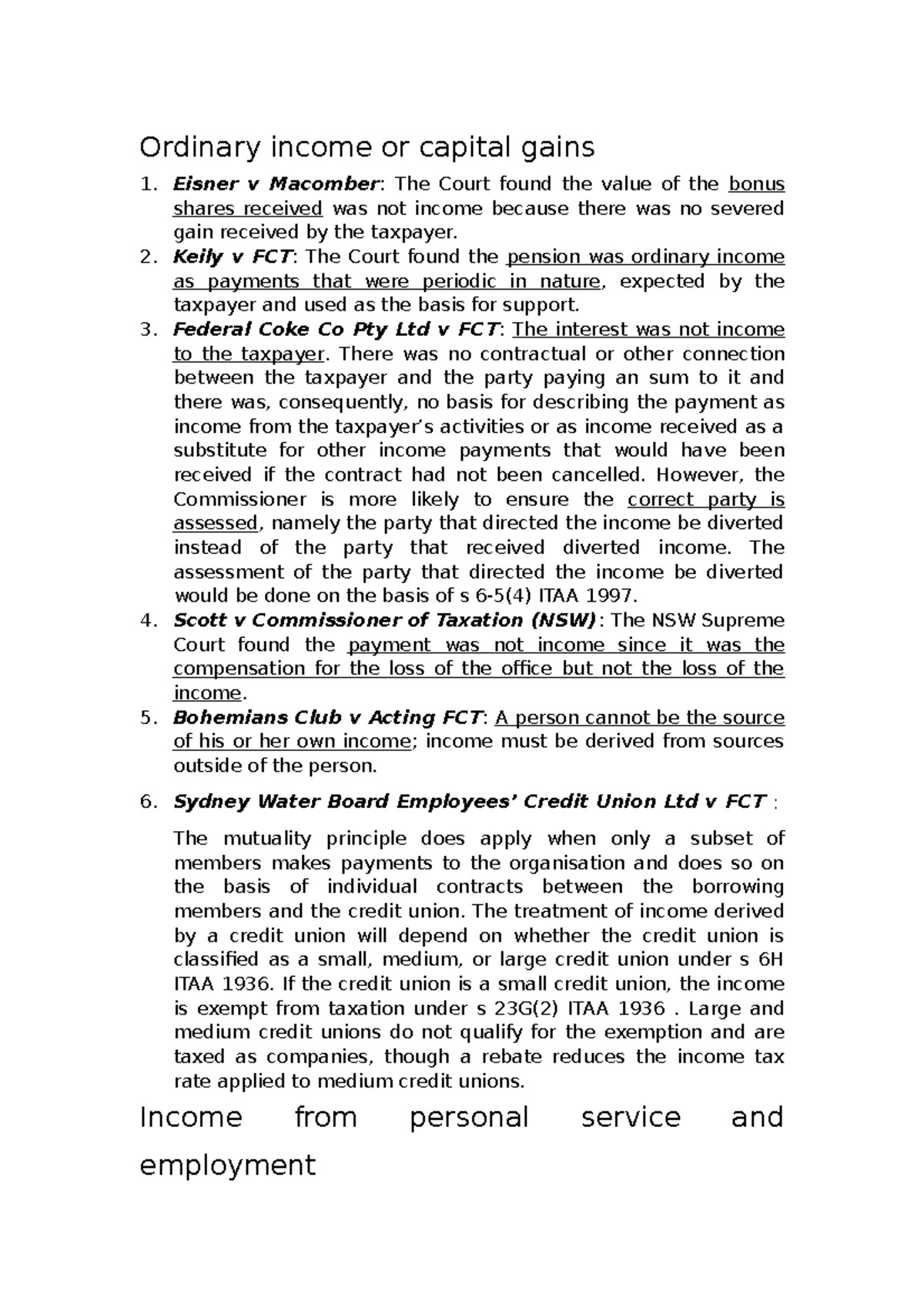

In general, the creation and management of an LLC are much easier and more flexible than that of a corporation. “S Corp vs. LLC.” Open a New Bank Account. S corps, like LLCs, are separate entities to their owners that provide a shield of liability protection, securing your assets in business debt or litigation. Typically, an LLC taxed as a sole proprietorship pays more taxes and S Corp tax status means paying less in taxes. By default, an LLC pays. But S Corp owners may be able to save more than enough on self-employment taxes to make up the difference. Get help setting up your S Corp. Where are you. An LLC passes taxes to owners and protects their personal assets; an S corporation is a tax-filing status that allows a company to pass taxes to. Without the S corporation designation status, LLC owners are responsible for a self-employment tax of % on net profits. With an S corp designation, business. An S Corp is a tax status (totally separate deal). You can elect to be taxed as an S Corp either as an LLC or as a Corporation. If you're self-. An LLC, or Limited Liability Company, is a legal business structure, while an S Corp is a tax qualification. An S Corp typically offers self-employed a better deal than LLCs, partnerships, or sole proprietorships. What's the Difference Between an S Corp vs LLC? LLCs. In general, the creation and management of an LLC are much easier and more flexible than that of a corporation. “S Corp vs. LLC.” Open a New Bank Account. S corps, like LLCs, are separate entities to their owners that provide a shield of liability protection, securing your assets in business debt or litigation. Typically, an LLC taxed as a sole proprietorship pays more taxes and S Corp tax status means paying less in taxes. By default, an LLC pays. But S Corp owners may be able to save more than enough on self-employment taxes to make up the difference. Get help setting up your S Corp. Where are you. An LLC passes taxes to owners and protects their personal assets; an S corporation is a tax-filing status that allows a company to pass taxes to. Without the S corporation designation status, LLC owners are responsible for a self-employment tax of % on net profits. With an S corp designation, business. An S Corp is a tax status (totally separate deal). You can elect to be taxed as an S Corp either as an LLC or as a Corporation. If you're self-. An LLC, or Limited Liability Company, is a legal business structure, while an S Corp is a tax qualification. An S Corp typically offers self-employed a better deal than LLCs, partnerships, or sole proprietorships. What's the Difference Between an S Corp vs LLC? LLCs.

We explain the differences between LLCs and S-corps, as well as how the choices you make can affect your business taxes. This post looks closely at the differences between an LLC vs S-corp. It compares LLC tax benefits against S-Corp tax benefits. It also provides limited liability protection. Quick Comparison Entity Chart. View our chart to see the basic differences between a limited liability company. LLCs are less expensive and easier to set up than corporations, and they're not subject to double taxation. Corporations, on the other hand. Perhaps the most fundamental difference between an S Corp and an LLC is the way the entity is treated for tax purposes. While LLCs are often treated as pass-. There are several key differences between an LLC and S corp pertaining to ownership, management, and ongoing formalities. There are generally more stringent rules regarding ownership of S corps than LLCs but neither has any major hurdles for most small businesses. S corps formed in. But an S corporation (S corp) isn't a business entity at all. It's a tax status that an LLC or a corporation can apply for with the IRS if it meets certain. S Corp vs LLC (3 MOST Important Differences and Which is Better) · Ownership. The IRS doesn't restrict the ownership of an LLC, but S Corporation ownership is. LLCs offer simplicity and flexibility, making them ideal for small businesses and solo entrepreneurs. S Corps provide potential tax advantages and are better. Otherwise, an S corp may be better, as it often is for any large, complex company. Tip. Read our reviews of. I wouldn't say it's better. An S-Corp is a bit more difficult to set up and manage, and there are more rules (like an entirely separate tax. One key advantage is its pass-through taxation. Like an LLC, an S Corp does not pay federal income taxes at the corporate level. Unlike an LLC, profits and. The simple answer is that an LLC is a business entity whereas an S-corporation is a tax classification for a corporation. An S-Corporation is an elective tax. Moreover, an LLC has fewer ownership restrictions compared to an S Corp. For instance, an LLC can have an unlimited number of members, and there are no. LLCs and C corporations are the two primary corporate entities in the United States. Each entity type has some features that are more advantageous for some. S Corporations are sometimes preferred over other entity types for tax reasons, as they enable owners to avoid self-employment taxes on a portion of their. Unlike pass-through entities such as sole proprietorships, partnerships, and S corporations, C corporations are separate taxable entities. This means the. LLC vs. S-Corp · LLCs provide liability protection for their members. · LLCs have far less paperwork up front and in the long-term. · S-Corps provide liability. What is the major difference between S corp and LLC? The major difference between an S-Corp and an LLC lies in their taxation and management structure. While.

Side Business For Extra Income

Become a Tutor. Tutoring is not only a great way to earn some money on the side, but it's also a very satisfying job. Students of all ages. You might not be in the spotlight, but being a TV or movie extra can make your bank account feel like a star. Depending on where you live, it may be a cinch to. I have some extra free time on my hands and want to start a side hustle or a small business to earn some extra money, but I'd also like to. The average monthly income for side hustles is $, but most side hustlers make $ or less. Source: hotel-rosa-ski-inn.ru Popular side hustles for the gig economy. 1. "Side Hustle" is a term that I use often. It is simply creating additional income to help reach your goals. In these videos I will be. hotel-rosa-ski-inn.ru: Side Hustle: Build a side business and make extra money - without quitting your day job: Guillebeau Chris: Books. 17 side hustle ideas for extra cash · 1. Pet sitting or dog walking · 2. Become an assistant · 3. Car washing and detailing · 4. Deliver packages · 5. Become a. I churn credit cards and bank accounts for extra money. When I don't have anything to do at work I'll sign up for a bank account or a new credit. Best ways to earn extra money · House sitting · Dog walking · Freelance work · Grocery delivery. Become a Tutor. Tutoring is not only a great way to earn some money on the side, but it's also a very satisfying job. Students of all ages. You might not be in the spotlight, but being a TV or movie extra can make your bank account feel like a star. Depending on where you live, it may be a cinch to. I have some extra free time on my hands and want to start a side hustle or a small business to earn some extra money, but I'd also like to. The average monthly income for side hustles is $, but most side hustlers make $ or less. Source: hotel-rosa-ski-inn.ru Popular side hustles for the gig economy. 1. "Side Hustle" is a term that I use often. It is simply creating additional income to help reach your goals. In these videos I will be. hotel-rosa-ski-inn.ru: Side Hustle: Build a side business and make extra money - without quitting your day job: Guillebeau Chris: Books. 17 side hustle ideas for extra cash · 1. Pet sitting or dog walking · 2. Become an assistant · 3. Car washing and detailing · 4. Deliver packages · 5. Become a. I churn credit cards and bank accounts for extra money. When I don't have anything to do at work I'll sign up for a bank account or a new credit. Best ways to earn extra money · House sitting · Dog walking · Freelance work · Grocery delivery.

9 Side Hustle Ideas · Digital marketing services · Bookkeeping · Teaching or tutoring · Babysitting or pet sitting · Dropshipping · Creative products or services. Side Hustle Ideas to Make Extra Money · 1. Rent out a room or your whole house · 2. Get Paid to Grocery Shop · 3. Become a Proofreader · 4. Be a Virtual Assistant. If you want to build a business to earn additional income on the side, you can try dropshipping. This business model lets you sell products online without. 10 ways to earn extra cash · Hold a yard sale · Sell your stuff online · Make things to sell · Sell at a farmers market · Babysit or pet-sit · Rent out a room · Teach. If you're tech-savvy, testing the latest apps and platforms can be an exciting side hustle for you. This online business idea lets you earn extra cash by. This hustler created digital workbooks that help people focus on their financial goals, like affording a baby or starting a business. Selling these digital. Miscellaneous ways to make extra money. · Cuddle with strangers · Scoop poop · Place advertisements on your car, home, or even on your body · Help crew a. I've found a few side hustles that can pay well. Freelancing in writing or graphic design is popular and can earn you a good income based on. If you want to build a business to earn additional income on the side, you can try dropshipping. This business model lets you sell products online without. Why do people work a side hustle? · A way to make extra money on the side · Pay off student loans faster · Supplement a full-time income · Increase financial. There are many different side hustles that can help you earn extra income. Some popular ones include tutoring, freelancing, pet sitting, selling. Some are good for a quick buck, while others could turn into consistent streams of income — even a career. You could even get started on a few of these side. Business ideas to generate side income · 1. Rideshare driver. Living in an area with lots of bars, restaurants and nightlife might earn you a few extra bucks if. job for his side hustle—now he makes $14, per month · Megan Sauer · Side 4 ways to earn extra cash this summer, from people whose side hustles bring. 25 Best Side Hustles From Home (Side Gigs) · Bookkeeper ($19 per hour) · Career Coach ($24 per hour) · Curriculum Writer ($33 per hour) · Copy Editor ($25 per hour). 44 Side Hustle Ideas to Make Extra Money in Do you need some extra cash? Here are 44 side hustles for making money on the side. From freelancing to selling. One partner can focus on bringing in business, communicating with clients, and scheduling, while the other can take charge of providing personalized care. The best side hustles for people in full-time employment · Freelance marketing, writing and proofreading · House-sitting and pet-sitting – especially easy if you. Our top 10 side hustle jobs to consider · Video editing · Writing · Photography · Tutoring · Sell crafts on Etsy · Housekeeping/Organising · Put your handyman skills. Put those skills together, and you'll be ready to seek out part-time work and extra income through a social media manager side hustle. Average Social Media.

Premium Carpet Price Per Square Foot

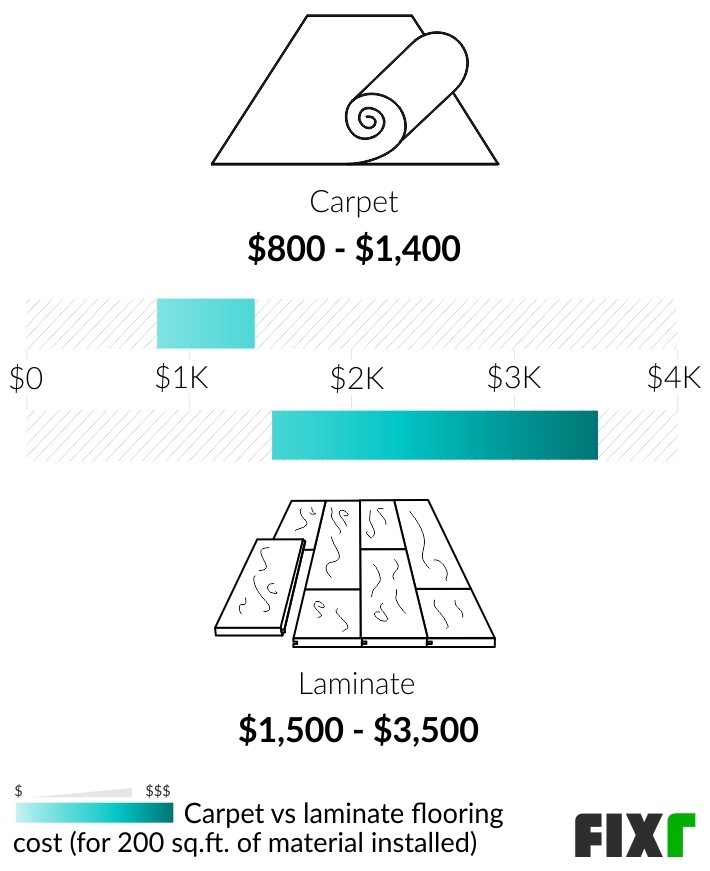

Carpet - Best Quality Plush (50 - 60 Oz.)- Installed with Pad – $ to $ per sq. ft. Their nicer formal plushes generally run in the $ per SQ/FT range. Buying Fabrica Carpet is like purchasing a luxury car. Is it absolutely necessary? No. $ cents per square foot is the same price as $ per square yard. $ cents per square foot is the same price as $ per square yard. The price. What is the average cost per square foot for carpet? ; Cut Pile Carpet. Rs 45 per sq ft ; Elevation Modular Carpet. Rs 70 per sq ft ; Circ Modular Nylon Carpet. Rs. Sophisticated, premium quality carpet in a variety of solid colors and patterns Budget-friendly carpet that offers value without sacrificing style. A. Aladdin Commercial Scholarship II Carpet Tile Steel Gray 24" x 24" Premium (96 sq ft/ctn). On average, carpeting costs range from $3 to $12 per square foot, covering both materials and labor. This means the total cost for carpeting a. (average length of a tenant's stay) For builder-grade carpet, the average price is going to run anywhere from $ to $ per square foot. And that will be. Use our calculator to provide a general estimate on the amount of carpet you will need based on room sizes. Carpet - Best Quality Plush (50 - 60 Oz.)- Installed with Pad – $ to $ per sq. ft. Their nicer formal plushes generally run in the $ per SQ/FT range. Buying Fabrica Carpet is like purchasing a luxury car. Is it absolutely necessary? No. $ cents per square foot is the same price as $ per square yard. $ cents per square foot is the same price as $ per square yard. The price. What is the average cost per square foot for carpet? ; Cut Pile Carpet. Rs 45 per sq ft ; Elevation Modular Carpet. Rs 70 per sq ft ; Circ Modular Nylon Carpet. Rs. Sophisticated, premium quality carpet in a variety of solid colors and patterns Budget-friendly carpet that offers value without sacrificing style. A. Aladdin Commercial Scholarship II Carpet Tile Steel Gray 24" x 24" Premium (96 sq ft/ctn). On average, carpeting costs range from $3 to $12 per square foot, covering both materials and labor. This means the total cost for carpeting a. (average length of a tenant's stay) For builder-grade carpet, the average price is going to run anywhere from $ to $ per square foot. And that will be. Use our calculator to provide a general estimate on the amount of carpet you will need based on room sizes.

The Average Cost Per Square Foot · Carpet: $1 - $4 · Padding: $ · Installation.

Most carpet installation cost estimates stick with the mid-point new carpet installation price at $5 – $7 per square foot. Wool carpeting is a premium fabric. Carpet Calculator estimates the cost of installing different types of carpet in your house. Carpet prices range from - 10 per square foot depending on. Carpet installation costs, on average, around $3–$11 per square foot. Get In some cases, installers may adjust the per-square-foot price if you need multiple. Premium Carpet Padding. 6 Pound 1/2″ Premium Carpet Padding. In Stock. Price: $ per Sq Ft. Category: Carpet Padding Tag: Carpet Padding. Share. Description. I told him I could get $ per square foot of the carpet directly from the warehouse and 1/2inch 8 pound carpet pad for only per square foot. Price. $2 - $ Fiber. SmartStrand36items · Nylon28items · Wool13items 8 Colors Available. $ / square foot · Dove Creek. 7. The cost of carpet installation ranges from $ to $ per square foot, on average, for labor and materials. Luxury vinyl can be priced from $2-$5 per square foot including the cost of installation for commercial products. However, when factoring in long-term. Price. Fiber. SmartStrand39items · Nylon1item · Polyester2items · Everstrand11 $ / square foot · Tonal 5 Colors Available. $ / square foot. According to HomeAdvisor, the national average labor costs for carpet installation is “$ to $1 per square foot.”. The average cost for carpet installation in the United States is typically in the range of $3 to $6 per square foot. Here's a rough estimate for. Premium materials can drive costs up to $6 per square foot. To illustrate, a 1,square-foot installation with high-end carpeting can range from $6, to. As a proud partner of Stanton, Carpet Express offers the best prices and values on all of their premium carpet collections. Price per square feet. From. To. Their legacy of excellence in carpet is backed by their wide flooring selection at an affordable price point. $3 / square foot. On average, Shaw carpet costs will range from $ to $ per square foot or $ to $ per square yard. Finished Floor Area square feet. Flooring Grade Basic - builder grade premium materials, custom built products and project supervision will result in. price-per-text: Price Per Square Feet. Description. Mohawk Pet Premier Diffurent Choice III Residential Carpet. The Mohawk Pet Premier Diffurent Choice III is. The basic cost to Install Carpet is $ - $ per square foot in April , but can vary significantly with site conditions and options. At approximately $ to $11 per square foot to install carpet in your house, the square footage will be the most significant determinant of your carpeting.

How Much Can A Bank Loan

A maximum loan amount describes the total sum that one is authorized to borrow on a line of credit, credit card, personal loan, or mortgage. · In determining an. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Typically around 90 cents can be loaned out and about 10% has to be kept as cash. However, what will usually happen is that the bank will. In this example, the borrower will receive $18, and will make 36 monthly payments of $ Loan amounts range from $1, to $40, and loan term lengths. Borrowing power is the amount you can borrow from your lender. The more borrowing power or capacity you have, the higher the loan amount or credit limit you can. Small Business Administration (SBA) loans offer easier qualification, longer loan terms and lower down payments. As a Preferred SBA Lender, we can show you how. You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Estimate your FICO ® Score range. Maximum loan amount for existing customers is $50k. Make an appointment Loan details. use a regions account balance as collateral. Deposit Secured. How much mortgage might I qualify for? Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. A maximum loan amount describes the total sum that one is authorized to borrow on a line of credit, credit card, personal loan, or mortgage. · In determining an. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Typically around 90 cents can be loaned out and about 10% has to be kept as cash. However, what will usually happen is that the bank will. In this example, the borrower will receive $18, and will make 36 monthly payments of $ Loan amounts range from $1, to $40, and loan term lengths. Borrowing power is the amount you can borrow from your lender. The more borrowing power or capacity you have, the higher the loan amount or credit limit you can. Small Business Administration (SBA) loans offer easier qualification, longer loan terms and lower down payments. As a Preferred SBA Lender, we can show you how. You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Estimate your FICO ® Score range. Maximum loan amount for existing customers is $50k. Make an appointment Loan details. use a regions account balance as collateral. Deposit Secured. How much mortgage might I qualify for? Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses.

Personal loans from Wells Fargo are a great way to manage debt, fund special purchases, or cover major expenses. Apply online. SBA Loan Program · Low down payment as little as 10% · Can be used to finance equipment and build, improve, refinance or purchase owner-occupied commercial. Intrafamily loans, which can be offered at rates lower than those for mortgage and personal loans, can help borrowers save big on interest. Intrafamily loan. Unlike development banks, the IMF does not lend for specific projects. Crises can take many different forms. For instance: Balance of payment. Amount to borrow. Enter your amount to borrow from $1, to $50, The maximum loan amount for those who are not current U.S. Bank customers is $25, How do you want to use your loan? · Buy a car · Consolidate debt · Cover an unexpected expense · Finance an important purchase · Pay for home improvements. Considering a personal loan? Get the essential info on what it entails, the ease of application, and how it can help fulfill your financial goals. 6 min read. With minimum loan amounts starting at $7, you can choose the term you're most comfortable with. Loans are available with or without collateral. Whatever loan. The mortgage you could afford depends on many factors, including your total monthly payment, income, debt obligations, creditworthiness, down payment amount and. Private mortgage insurance (PMI). If your down payment is lower than 20%, your loan-to-value ratio for conventional financing will be higher than 80%. %% Interest rate · $2, to $50, Loan amount · 36 to 60 months2 Term · No origination or application fees, and no prepayment penalty Fees. How much can I apply for and what loan terms are available?Expand · 12 – 36 months for personal loans ranging from $3, to $4,Footnote 1 · 12 – 84 months. Top home mortgage FAQs · How does my credit rating affect my home loan interest rate? · Do I need to get a home appraisal in order to get a home loan? · How long. It's usually between 1% and 5%, but sometimes it's charged as a flat-rate fee. For example, if you took out a loan for $20, and there was a 5% origination. Where can you find loans with collateral? · Banks: If you already have an account with a bank, you may be able to get bank loan funds on the same day you apply. A mortgage loan is likely the largest amount of money you'll borrow in your lifetime and allows you to purchase a home and build equity. There are many types of. Pre-qualification gives you an overview of your borrowing capacity, while pre-approval guarantees your financing and protects your rate for 90 days. Many private student loans require payments while you are still in school, but some do allow you to defer (put off) payments while in school. Interest rates. Loan amounts from $2,$50,; Simple, digital application for loan amounts up to $25,; Terms available: 12 - 60 months; Annual Percentage Rates range. Some loan programs set restrictions on how you can use the funds, so check with an SBA-approved lender when requesting a loan. Your lender can match you with.

Pos Monthly Fee

POS Pro is the upgrade for your retail locations and it costs $89 USD/month/location. On POS Pro, you get advanced features designed for businesses selling from. Online Transactions: For e-commerce, the fee may vary, often around % + 30¢ per transaction. Subscription Plans: Square may offer subscription plans with. The POS service fee covers service and support only. All pre-payments are Monthly service fee based on plan. $/mo. Terminal Assurance optional. The Pro plan costs $ per month and is recommended for restaurants with tickets above $30 as well as those with multiple registers or multiple locations. Epos Now. Powering 63, Businesses; Best For Retail; Monthly Fee: Start for $99 ; Lightspeed. Over $87 Billion Processed; Best For Restaurants; Monthly Fee. iPos POS pricing includes free software and no monthly fees. Hardware plans from basic free to premium customized. So, how much does Square cost for its Retail POS Plus plan? You just need to pay $89/month per location to experience all those features. Besides monthly Square. Software Costs: Pricing can range from $0 for basic, limited-feature versions to $$ per month for more advanced, cloud-based systems. Harbortouch POS systems start at $29 per month (per POS terminal) with no monthly support fee. New customers only. POS Pro is the upgrade for your retail locations and it costs $89 USD/month/location. On POS Pro, you get advanced features designed for businesses selling from. Online Transactions: For e-commerce, the fee may vary, often around % + 30¢ per transaction. Subscription Plans: Square may offer subscription plans with. The POS service fee covers service and support only. All pre-payments are Monthly service fee based on plan. $/mo. Terminal Assurance optional. The Pro plan costs $ per month and is recommended for restaurants with tickets above $30 as well as those with multiple registers or multiple locations. Epos Now. Powering 63, Businesses; Best For Retail; Monthly Fee: Start for $99 ; Lightspeed. Over $87 Billion Processed; Best For Restaurants; Monthly Fee. iPos POS pricing includes free software and no monthly fees. Hardware plans from basic free to premium customized. So, how much does Square cost for its Retail POS Plus plan? You just need to pay $89/month per location to experience all those features. Besides monthly Square. Software Costs: Pricing can range from $0 for basic, limited-feature versions to $$ per month for more advanced, cloud-based systems. Harbortouch POS systems start at $29 per month (per POS terminal) with no monthly support fee. New customers only.

Most charge a monthly fee for software. Some providers charge a low monthly subscription rate and allow you to choose your own credit card processor. · Monthly. After the day trial period, the cost for Virtual Terminal is $ per month when no other software plan is in effect. Trial period and monthly cost is. POS Software and Inventory Control, No Monthly Fees, Free Support & Updates - CashFootprint Retail Point of Sale Software by LotHill Solutions - Standard. Volcora POS Monthly Plan Thank you for choosing Volcora Cloud POS. Currently you are only able to select Starter, Standard and $ $ Unit price. Starting at $35/mo. Square Email Marketing. Stay connected to customers with POS-integrated, automated email marketing. BPA Restaurant Professional. $55 monthly license and support which covers software and most hardware issues; No additional monthly fee for additional stations. Square Point of Sale software is a free POS system – there are no setup fees or monthly fees. Only pay when you take a payment. Monthly. Save with Lightspeed Payments. Basic. Designed for essential day-to-day needs for independent retailers. USD /mo. Select. Per month: Base plan cost. Start for free. and supercharge your business. ; Point of Sale. $ USD/month ; POS + Payment Processing. $ USD/month ; Enterprise. Enterprise-ready. After the day trial period, the cost for Virtual Terminal is $ per month when no other software plan is in effect. Trial period and monthly cost is. Transparent POS pricing designed for your business · From just $99 per month, find the right POS plan for you · Transparent rate processing · Flat pricing compared. I'm opening a new cafe in America and I've been looking between Clover and Toast as a POS. I was shocked by how high the monthly fees are. We leverage our buying power to offer several full featured and widely installed POS systems with no monthly fees. Call us at to discuss our two. Software: $0 in software-associated fees · Additional Features: $0 · Credit Card Processing: A fraction of competitors'. · Hardware: $0 monthly fees after you. Monthly software subscription. Choose your own hardware. Cloud-based point of sale. Custom hardware configuration. Shopify POS Pro is an add-on subscription for $89 a month that unlocks additional features of your POS. If your retail business has several locations, multiple. With Pay As You Go, there are no monthly subscription fees. You simply pay a 1% transaction fee when you process card payments. Thinking about getting a POS System called Quantic and the Monthly payment would be about plus a initial cost for equipment. This this high or average. Free plan details. Helcim's free POS software includes reporting, inventory management and unique user permissions. · Monthly cost. $0. · Payment processing fees.